Welcome to the latest edition of our client newsletter,

Our articles cover a range of topics which we hope you will find interesting. We aim to keep you informed of changes as they happen, but we also want to provide ideas to help you live the life you want now and in the future.

In this edition we discuss about “Shares around record highs as inflation slides” and provide you with information on “Housing affordability” and “How Financial Advisers can help regarding your Finances”.

If you would like to discuss any of the issues raised in this newsletter, please don’t hesitate to

contact us.

In the meantime, we hope you enjoy the read.

All the best,

Planet Wealth

– but what about the Israel/Iran conflict & other risks?

– Recession risks, the escalating Israel conflict, the US election along with still stretched valuations mean a high risk of another share market correction and continued volatility.

– The expansion of the war around Israel and Iran attacking Israel with more missiles is very concerning but unless oil supplies are disrupted the impact on global growth and shares will remain limited. share market correction and continued volatility.

– However, the combination of global rate cuts, still okay global economic growth and Chinese stimulus are very positive for shares on a six-to-12-month horizon. share market correction and continued volatility.

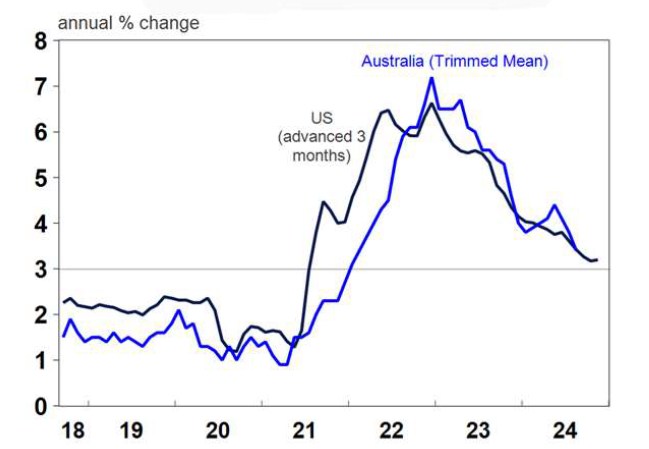

– While the RBA remains relatively hawkish, the resumption of falling underlying inflation since May tells us that the start of rate cuts here is getting closer.

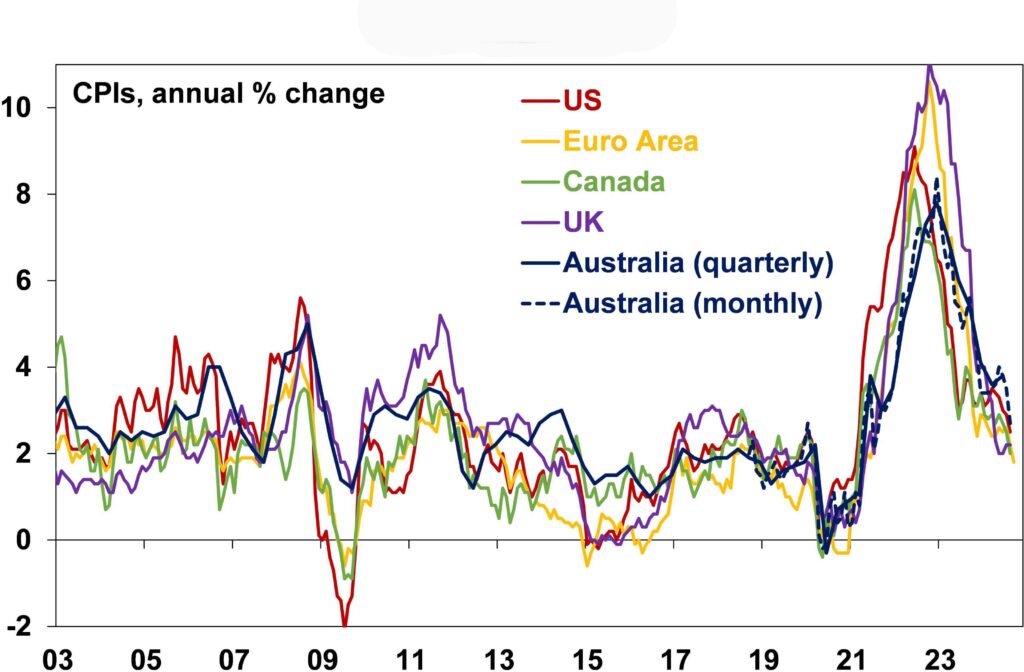

August and September are often weak months but despite a few wobbles US, global and Australian shares rose to record highs. And consistent with the “risk on” sentiment metal prices, gold and the $A are up and the $US has fallen. The key drivers have been central banks cutting rates as inflation falls, still reasonable global growth and news of aggressive stimulus in China. But what are the risks and why is the RBA lagging on rates?

Success in getting inflation down is the main driver of market cheer. Its surge depressed markets in 2022 (as higher inflation means higher interest rates and lower price to earnings multiples) and its decline has enabled them to rebound. In major developed countries it peaked around 8-11% in 2022 and has now fallen to around 2-3%.

Source: Bloomberg, AMP

The rise in inflation in 2021-22 was a classic case of too much money or demand (on the back of pandemic stimulus and then reopening) chasing too few goods and services (as supply was constrained). Its reversal reflects the reversal of fiscal stimulus, improved supply chains and monetary policy going from easy to tight. In particular, the aggressive monetary tightening helped slow demand and, by signalling that central banks were serious about getting inflation back to target, helped keep inflation expectations down. This in turn has made it easier to get inflation back down.

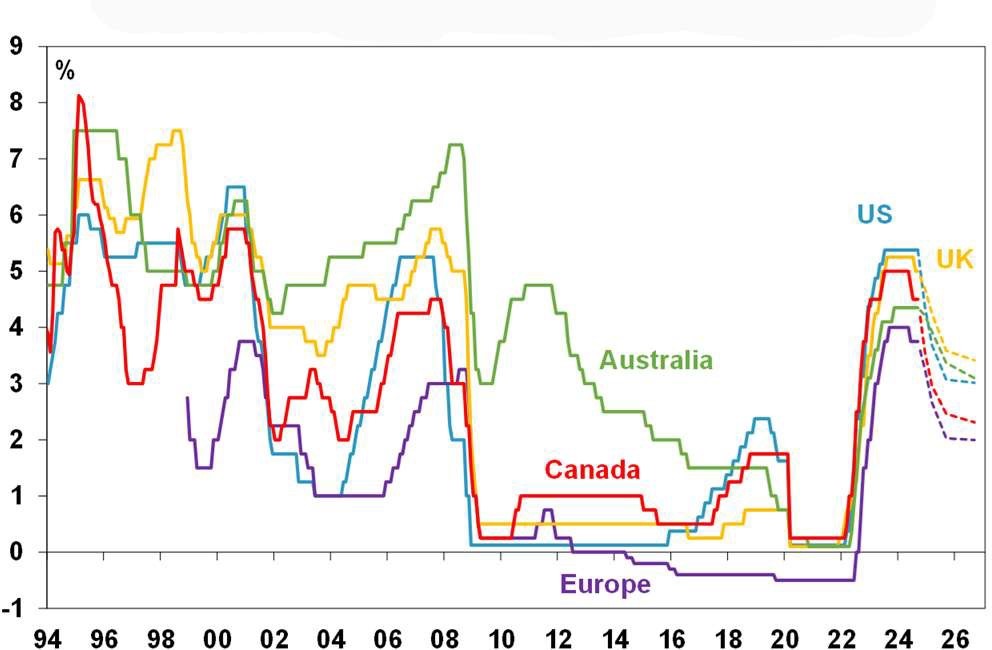

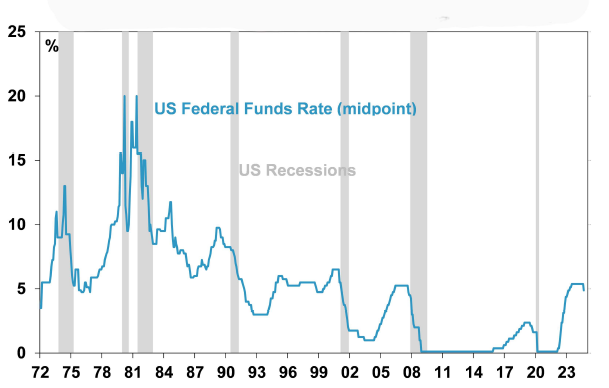

With inflation heading back to targets, central banks have been able to start cutting interest rates with nearly 50% of global central banks, including the Fed, now cutting. Money markets are expecting further easing ahead.

Source: Bloomberg, AMP

The good news has been that central banks have been able to get inflation back down without causing a collapse in global growth or sharply higher unemployment in contrast to the experience of the 1970s, 80s and 90s. Of course, conditions vary – with the US still strong and Europe weak – but global growth still looks on track to be around 3% this year.

This has also come at a time when the Chinese government has announced a big step up in policy stimulus. This included substantial monetary easing and a commitment to increased counter cyclical fiscal policies, “necessary” levels of fiscal spending and measures to stop the property decline.

So, shares celebrated. Apart from still stretched valuations, there are four key issues. Is recession still a risk? What about geopolitical threats including the Middle East? Will China stimulus work? And what about the RBA?

(Note: The US port strike is also a risk, but I doubt it will have a lasting impact – remember similar worries about Red Sea shipping disruptions and the Baltimore bridge collapse.)

Falling interest rates are positive for shares as they help boost economic and profit growth and make shares relatively more attractive than cash. So, the first rate cut after a hike tends to be positive for shares. Unless there is a recession! The table below shows the US share market’s response after the first rate cut since 1981. The US share market rose over the subsequent 3, 6 and 12 months after the commencement of 6 of the last 9 Fed easing cycles. The exceptions were after the rate cuts in 1981, 2001 and 2007 which were associated with recessions and the period after the first 2019 cut saw a “recession” and brief plunge in shares due to the pandemic. The reaction by the Australian shares to US rate cuts is similar.

| First rate cut | +3mths % | +6mths % | +12mths % |

| July 81 | -6.9 | -8.0 | -18.2 |

| Sept 84 | 0.7 | 8.8 | 9.6 |

| Nov 87 | 1.3 | 4.6 | 11.0 |

| June 89 | 9.8 | 11.1 | 12.6 |

| July 95 | 3.5 | 13.2 | 13.9 |

| Sep 98 | 20.9 | 26.5 | 26.1 |

| Jan 01 | -8.5 | -11.3 | -17.3 |

| Sept 07 | -4.3 | -12.4 | -20.6 |

| July 19 | 1.9 | 8.2 | 9.8 |

| Average | 2.0 | 4.5 | 3.0 |

US recession highlighted in red. Source: Thomson Reuters, AMP

And as can be seen in the next chart, recessions often start after the first Fed rate cut – so a cut doesn’t necessarily mean recession will be avoided.

Source: Bloomberg, AMP

Our base case is that the Fed has just headed off a recession and indications continue to show solid growth in the US. But a recession is a high risk with the US yield curve and leading indicators continuing to point to recession and US jobs leading indicators – for example, a sharp downtrend in job openings and quits – showing significant weakness. It’s a similar story in Australia – a traditional recession should be avoided but it’s a high risk.

There are two main geopolitical threats at present: the Middle East and the US election. While the expanding war around Israel to include Hezbollah is a big concern from a humanitarian perspective, the key from an investment perspective is whether global oil supplies are impacted. The risks on this front have increased with Iran (which accounts for 3% of global fuel supply) attacking Israel with more missiles – and oil prices bouncing 5% or so, but only taking them to week ago levels. It could just turn out to be another exchange of missiles between Iran and Israel as we saw in April. So, much will depend on Israel’s response – if its proportional and focussed on Iranian military facilities then the oil price and shares will quickly settle down again. This will be helped by Saudi Arabia raising production in December, Libyan oil production (1% of supply) resuming and rising non-OPEC production. If alternatively, Israel escalates with an attack on Iranian nuclear or oil facilities then we could be in for a much rougher ride in share markets as things escalate impacting oil supply.

Since Kamala Harris took over as the Democrat presidential candidate share markets have not been particularly focussed on the US election. However, this could change as the race remains close and Trump’s policies on tariffs, tax cuts and immigration risk a new trade war and higher inflation which would be bad for shares. Of course, Trump may moderate his policies, but this will not be known for a while.

China’s package of stimulus announcements over the last week show the Government is now serious about wanting to boost growth after a run of weak data. If the moves were limited to easy money then they may be less effective as the cost of money is already low and the key problem is a lack of demand for money. So fiscal stimulus is also needed and the Chinese authorities at last appear to recognise this with a surprise Politburo meeting committing to significant fiscal

stimulus and measures to halt the property decline. Of course, the details are yet to be announced but this shift from cautious incremental stimulus towards “whatever it takes” is significant and very positive for cyclical assets like metal prices, Australian resources shares and the Chinese share market as we have seen in the last week. Whether it extends beyond providing a cyclical boost to growth to addressing China’s structural problems – which will require measures to clear the property overhang and permanently boost consumer spending – remains to be seen.

While other central banks have been easing, the RBA remains hawkish. This stems from a setback in falling inflation earlier this year. However, the key measures of underlying inflation have resumed falling. As can be seen in the next chart “trimmed mean” inflation (the RBA’s preferred measure of underlying inflation) is just following US core inflation down with a lag. So just as Australian inflation and the RBA followed global inflation and rates up with a lag in 2022 (due to a slower reopening from the pandemic) they now look to be following with a lag on the way down.

Source: Macrobond, AMP

The resumption of the downswing in underlying inflation provides confidence that rate cuts are getting closer. Our base case is that the RBA won’t cut until it’s seen lower underlying inflation in both the September and December quarters and so won’t start cutting until February next year. However, with inflation starting to follow a similar profile to that seen in the US, there is a high

chance of a December cut if underlying inflation continues to fall as it has since May. The US experience with falling inflation despite still okay growth and low unemployment tells us the RBA’s concerns about excess demand in Australia may be overstated.

Recession risks, the conflict in the Middle East, the US election along with still stretched valuations mean a high risk of another share market correction and continued bouts of volatility. However, the combination of global rate cuts, still okay global economic growth and Chinese stimulus are very positive for shares on a six-to-12-month horizon. While the RBA remains relatively hawkish the resumption of falling underlying inflation since May tells us that the start of rate cuts here is getting closer.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance.

This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

Key points

Apart from “what will home prices do?” and “where are the best places to buy a property?” the main debate around the Australian housing market has been about poor housing affordability, occasionally interspersed with a scare that home prices will crash. The most recent example of the latter was on 60 Minutes last week with a call by US demographer & economist Harry S Dent that Australian house prices could fall “as much as 50% in the coming years”. But how serious should we take forecasts for a crash? And more fundamentally how do we fix affordability?

The basic facts regarding the Australian housing market are well known:

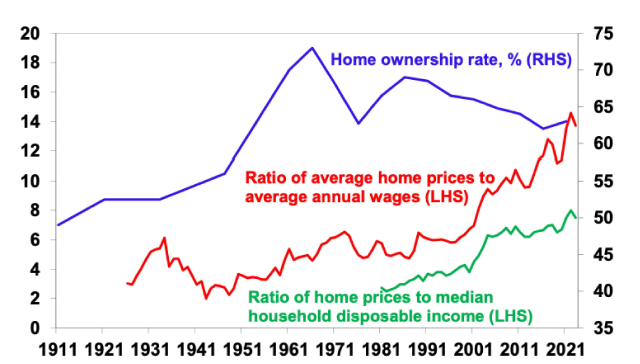

First, after strong gains in home prices over many years, it’s expensive relative to income, rents & its long-term trend and by global standards.

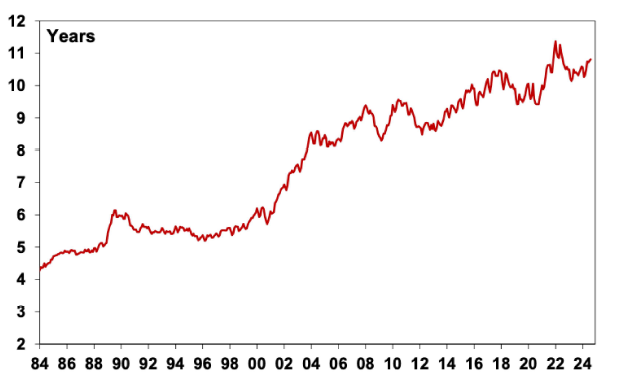

Second, flowing from this, housing affordability is poor:

Source ABS, Corelogic, AMP

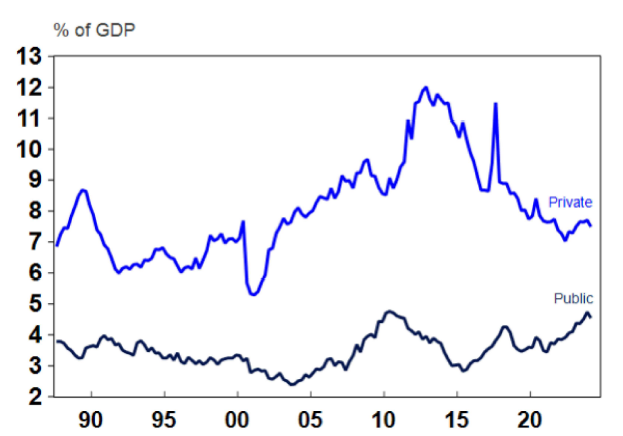

Source: ABS, AMP

Third, the surge in prices has seen our household debt to income ratio rise to the high end of OECD countries, which exposes Australia to financial instability on the back of high rates and or unemployment.

These things arguably make calls for some sort of crash seem plausible.

US commentator Harry S Dent’s forecast for an up to 50% fall in property prices is nothing new. Calls for an Australian property crash – say a 30% or more fall – have been trotted out regularly over the last two decades.

Of course, a crash can’t be ruled out, but as I have learned over the last two decades the Australia property market is a lot more complicated than many “perma property bears” allow for.

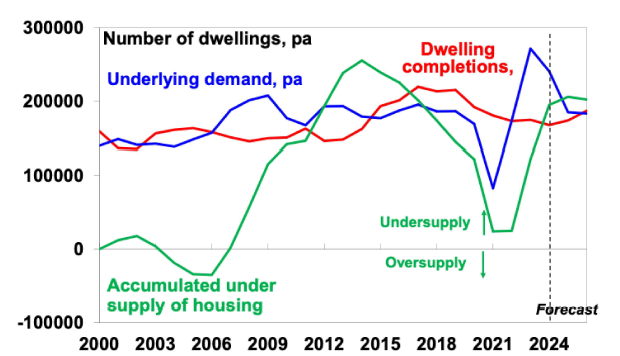

First, the property market is not just a speculative bubble fuelled by easy money and low interest rates. Sure low rates allowed us to pay each other more for homes but the key factor keeping them elevated relative to incomes has been that the supply of new dwellings has not kept up with demand due to strong population growth since the mid-2000s and more recently with record population growth resulting in an accumulated shortfall of around 200,000 dwellings at least but possibly as high as 300,000 if the reduction in average household size that occurred through the pandemic is allowed for. This partly explains why property prices have not collapsed despite the threefold rise in mortgage rates since May 2022.

Source: ABS, AMP

Second, the property market is highly diverse as evident now with strength in previously underperforming cities like Perth, Adelaide and Brisbane but weak conditions in Melbourne, Hobart and Darwin.

Thirdly, Australian households with a mortgage have proven far more resilient than many including myself would have expected in the face of the rate hikes in 2022 and 2023. This is evident in still relatively low mortgage arrears (of around 1% of total loans). This may reflect a combination of savings buffers built up through the pandemic including in mortgage pre payments and offset accounts, access to support from the “bank of mum and dad”, the still strong jobs market allowing people to work extra hours & an ability to cut discretionary spending (suggesting definitions of what constitutes mortgage stress may be overstating things). Of course, arrears are starting to rise as these supports recede, so the continuation of this resilience should not be taken for granted.

Finally, the conditions for a crash are not in place. This would probably require a sharp further rise in interest rates and/or much higher unemployment. Sharply higher interest rates from the RBA are unlikely as global inflationary pressure is easing and global central banks are now cutting. Our inflation & rates went up with a lag versus other countries & are likely to follow on the way down. Higher unemployment – with jobs leading indicators pointing to less jobs growth – is the biggest risk though.

So, a property price crash is a risk, but would likely require a deep recession. Our base case for average home prices remains for modest growth ahead of a pick-up after rates start to fall.

Of course, a house price crash would improve housing affordability – but it’s also a case of “be careful of what you wish for” because a crash would likely also come with a deep recession and sharply higher unemployment which could see many lose their homes along with a hit to incomes. However, improving housing affordability is critical as its long-term deterioration is driving excessive debt levels and increased mortgage stress and contributing to a fall in home

ownership (the blue line in the first chart). Of course, other factors have also driven falling home ownership since the 1960s including people starting work and family later in life, a decline in perceptions that owning a home is necessary for security & growth in other forms of saving beyond housing. But worsening affordability is likely a big contributor and falling home ownership due to this is something we should be concerned about as its contributing to increasing inequality and if it persists it could threaten social cohesion.

So, beyond crashing home prices, what can be done to boost housing affordability? My shopping list includes the following:

Source: Macrobond, AMP

Policies that won’t work, but are regularly put forward by populist politicians as solutions to poor affordability, include: grants & concessions for first home buyers (as they just add to higher prices); abolishing negative gearing (which would just inject another distortion into the tax system and would adversely affect supply), although there is a case to cap excessive use of negative gearing tax benefits; banning foreign purchases altogether (as they are a small part of total demand and may make it even harder to get new unit construction off the ground); and a large scale return to public housing (as a major constraint to more units is excessive costs and delays, and just switching to public housing won’t fix this).

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721,

AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.

Advice can play a critical role in helping Aussies manage financial stress

When it comes to financial advice, there’s a common misconception out there. People tend to think it’s all about numbers.

How much extra can you tip into super. What return your investments are making. How much you’re going to have in retirement.

And sure, the dollar amounts are important. But financial advice is about so much more than numbers on a spreadsheet. An adviser is someone to confide in and collaborate with to achieve your financial goals.

So, what do Australians think of financial advice? And how does it affect their overall financial wellbeing?

Recent research shows 11% of Australians have engaged an adviser over the past 12 months 1. This means almost 9 out of 10 Aussies aren’t getting professional help with their finances and are at the mercy of bogus advice from other sources – both online and offline. Mates down the pub. Random tweeters. Dr Google.

More than one in four (27%) people say they have been exposed to financial misinformation – and worryingly, 31% have acted on the incorrect information.

And the top sources of financial misinformation? Yes, not surprisingly it’s social media (37%) and online searches (20%).

So why aren’t Aussies seeking advice? Here are the top five factors putting people off.

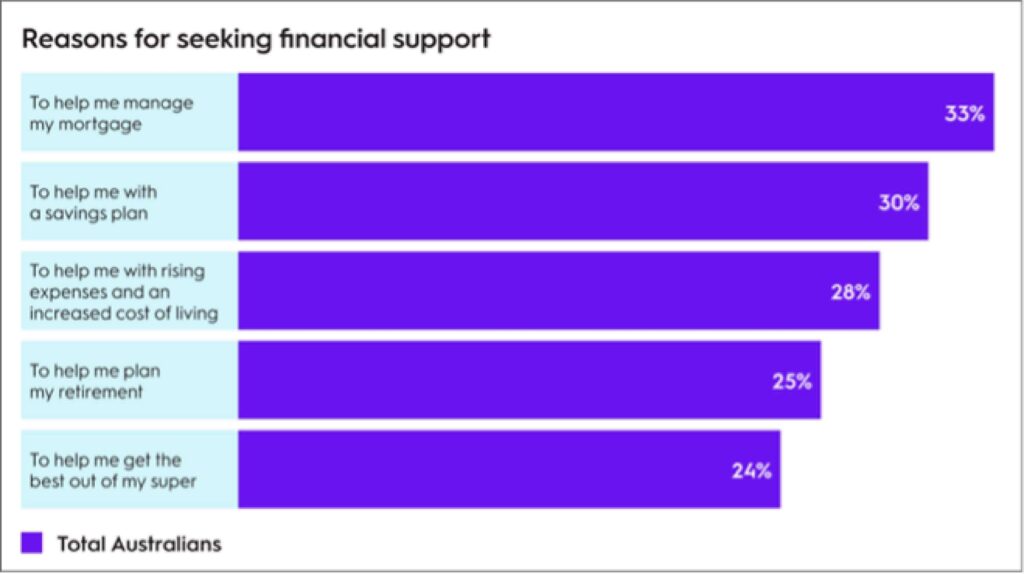

Research shows Aussies in 2024 tend to be a little more focused on day-to-day issues rather than planning for the future – home loan repayments, savings plan and cost of living challenges are rating higher than retirement planning and super strategies. This reflects a very real gap – that many people are missing out on planning for the long term, including their retirement.

One challenge when it comes to financial advisers, is the trust gap among Australians – those who have engaged with an adviser are more likely to trust them than those who haven’t.

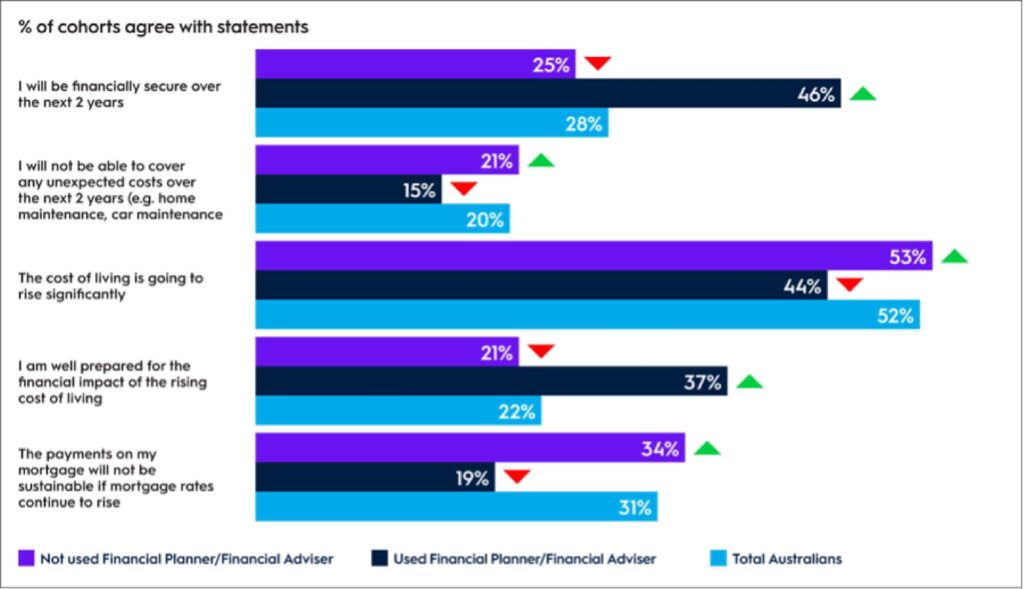

So how are advisers helping their clients…and what are Aussies not getting advice, missing out on?

It’s one of the most fundamental roles an adviser plays…setting clear, well-defined and achievable goals. And advisers are hitting it out of the park. The research shows Australians who have used an adviser feel a lot more organised. More of them have set clear financial goals and fewer of them haven’t got around to it, compared with Australians who aren’t getting advice.

21% of Aussies who say they have clear well-defined financial goals have used a financial adviser compared to only 9% of total Aussies.

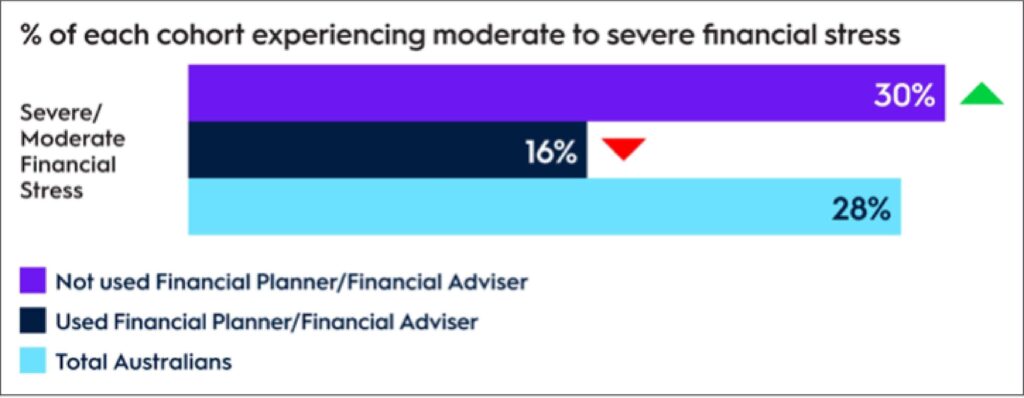

Advisers are clearly helping people manage their stress levels more effectively. Only 16% of advised Australians feel severely or moderately stressed, compared with 30% of the general population.

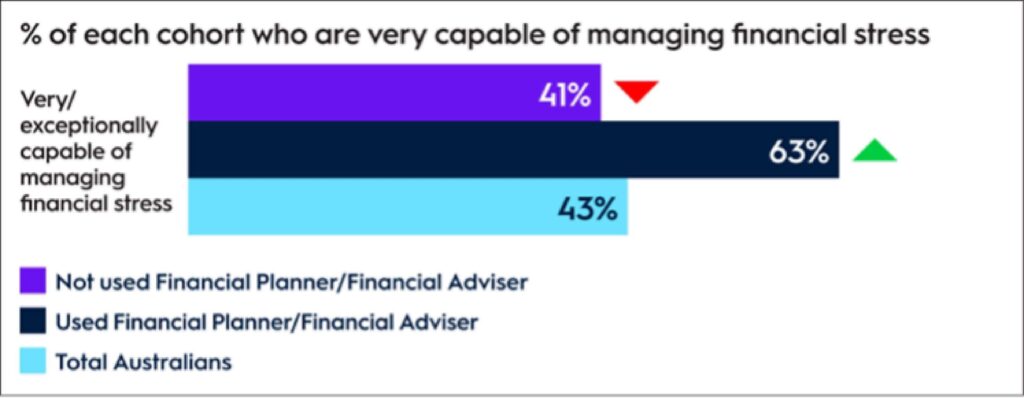

And almost two-thirds (64%) of people getting advice feel capable of managing daily financial stress well, compared with less than half (43%) of the total population.

From mortgage repayments to living costs, financial security and emergency planning, the research is unambiguous. Advised Australians feel significantly more positive about money matters and capable of handling any financial curveballs that might be thrown at them.

The research measured seven key pillars of mental wealth – mental wellbeing, happiness, financial stress management and resilience, work/life balance, personal growth, community support and psychological richness.

And there’s a clear link between financial stress and overall mental wellbeing – 48% of Australians rate their overall mental wellbeing as good but only 22% of Aussies who are moderately or severely financially stressed say the same. And half of us are happy with our lives overall, but that jumps to more than three in four (76%) of financially secure Australians.

So, by helping Aussies get to grips with their finances, advisers can play a vital role in improving the nation’s overall financial wellbeing.

We can guide you through the complexities of retirement planning and discuss some of the innovative retirement income solutions that are now available.

Disclaimer: This information is provided by AMP Financial Planning Pty Limited (AMPFP) ABN 89 051 208 327AFSL 232 706, Hillross Financial Services Limited (Hillross) ABN 77 003 323 055 AFSL 232 705 and Charter

Financial Services Limited (Charter) ABN 35 002 976 294 AFSL 234 665 Ph. 1800 021 466, all wholly owned subsidiaries of AMP and members of the AMP Group. Any advice contained in this document is of a general nature only and does not take into account the objectives, financial situation or needs of any particular person. Before making any decision, you should consider the appropriateness of the advice with regard to those matters. If you decide to purchase or vary a financial product, your advisers, AMPFP, Charter its associates and other companies within the AMP Group may receive fees and other benefits, which will be a dollar amount and/or a percentage of either the premium you pay or the value of your investments. Ask us for more details. If you no longer wish to receive direct marketing, please call your adviser.

Current as at October 2024

1 AMP Financial Wellness Report 2024

Planet Wealth

Planet Wealth

Planet Wealth Pty Ltd (ACN 137 467 362) as Trustee of the Planet Insurance and Financial Planning Unit Trust ABN 15 757 194 605 is an Authorised Representative and Credit Representative of AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licence 232706 and Australian Credit Licence 232706.

This information is provided by AMP Financial Planning Pty Limited (AMPFP) ABN 89 051 208 327 AFSL 232 706 and Charter Financial Services Limited (Charter) ABN 35 002 976 294 AFSL 234 655 Ph. 1800 021 466, both wholly owned subsidiaries of AMP and members of the AMP Group. Any advice contained in this document is of a general nature only and does not take into account the objectives, financial situation or needs of any particular person. Before making any decision, you should consider the appropriateness of the advice with regard to those matters. If you decide to purchase or vary a financial product, your advisers, AMPFP, Charter its associates and other companies within the AMP Group may receive fees and other benefits, which will be a dollar amount and/or a percentage of either the premium you pay or the value of your investments. Ask us for more details. Any general tax information provided is intended as a guide only and not to be relied upon. If you no longer wish to receive direct marketing, please call your adviser. To view our privacy policy visit AMP group privacy policy. AMP Advice is a trademark registered to AMP Limited ABN 49 079 354 519.

This website contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.

This website contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.

Planet Wealth Pty Ltd ACN 137 467 362 as Trustee of the Planet Insurance and Financial Planning Unit Trust ABN 15 757 194 605, is an Authorised Representative and Credit Representative of AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licence 232706 and Australian Credit Licence 232706