Welcome to the latest edition of “The 2024-2025 Budget”,

Our articles cover a range of topics which we hope you will find interesting. We aim to keep you informed of changes as they happen, but we also want to provide ideas to help you live the life

you want — now and in the future.

In this edition we provide you with information on “The 2024-2025 Budget”.

If you would like to discuss any of the issues raised in this Federal Budget, please don’t hesitate to contact us.

In the meantime we hope you enjoy the read.

All the best,

Planet Wealth

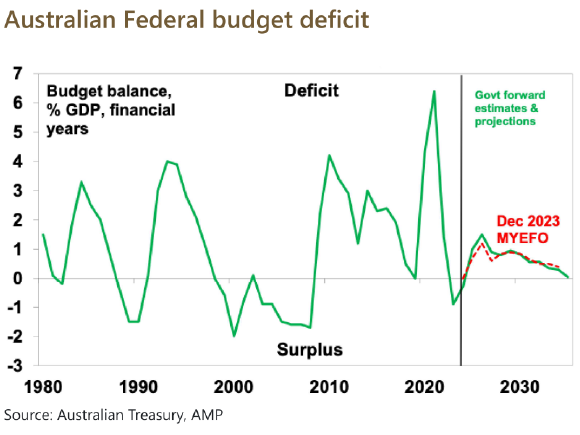

– The budget this year is expected to show a surplus of $9.3bn thanks to a continuing revenue windfall, but slip back into bigger deficits from 2024-25.

– Key measures include broader cost-of-living support & “Future Made in Australia” measures.

– Significant extra spending risks adding to inflation.

– Structural budget deficits remain in the medium term as the revenue windfall fades and spending remains high. Bigger government looks increasingly locked in.

The Budget is aimed at trying to lower inflation in the near term but supporting Government priorities including formally launching a “Future Made in Australia” (FMIA) over the medium term. In terms of the former, there is another round of cost-of-living subsidies designed to reduce measured inflation. In terms of the latter, it further cements bigger government and sees bigger deficits for the medium term.

Key measures, many of which were announced prior, include:

Budget savings include:

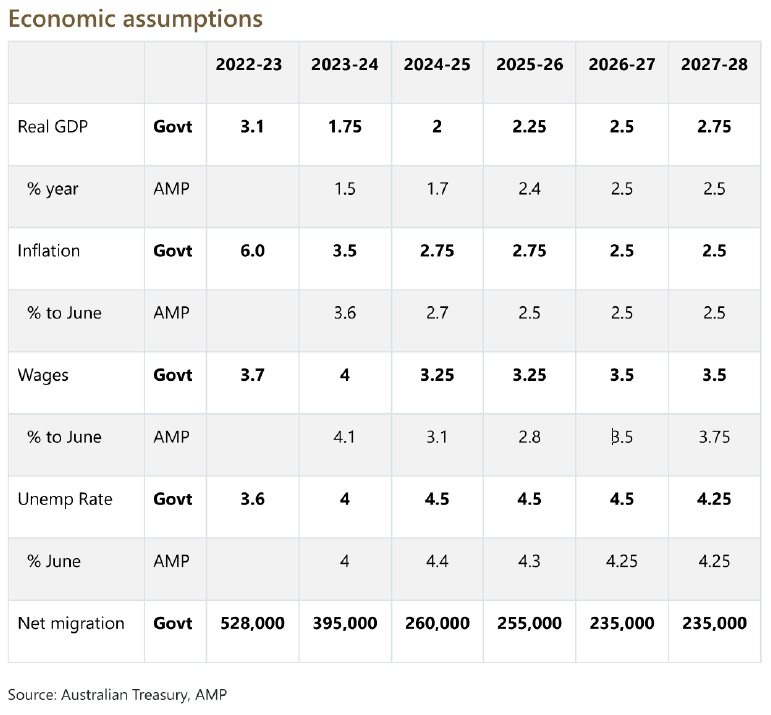

The Government left its growth forecasts unchanged for this year but revised them down slightly for the next two years. Notably it has revised down slightly its inflation forecasts and still sees wages growth slowing from here as does the RBA, but an obvious risk to this is that its support for wage increases in certain industries has a flow on effect to other industries (just as the aged care wage rises last year seems to be leading to higher wages for childcare workers). It also sees lower inflation this year and next than the RBA and this is partly due to a continuation of cost-of-living relief measures that it sees as lowering measured inflation (by 0.5% in 2024-25), whereas the RBA assumed the measures lapse.

The Government now sees net immigration of 395,000 this financial year (MYEFO was 375,000), falling to 260,000 in 2024-25, taking population growth down to around 1.4% from 2.4% in 2022-23. The Government kept its medium-term iron ore price assumption at $US60/tonne. With the iron ore price well above that (>$US100 as of May 2024), it’s still a potential source of revenue upside.

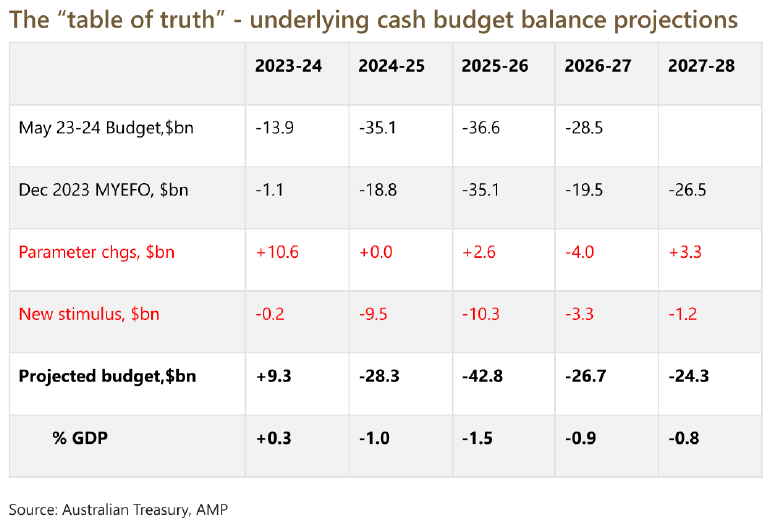

This Budget like all of those since 2020 has again benefitted from extra revenue flows coming from higher personal tax collections due to stronger jobs growth and higher commodity prices (and hence mining profits) than assumed. This is not smart management but good luck flowing from conservative forecasts. This windfall (see the line called “parameter changes” in the next table) is estimated to reduce the deficit this financial year by $10.6bn compared to last December’s update, with a total benefit over the five years shown of $12.6bn. But this table — a more detailed version of which appears in the Budget papers and is nicknamed the “table of truth” — also shows how much of the windfall has been spent (see the line called “new stimulus”). Last year only 14% of the windfall through the forward years was spent but this budget nearly twice the windfall (i.e. $24.4bn) is being spent. As a result, while the budget now looks better for this financial year (with another surplus — which could turn out to be even bigger), because of the extra spending in subsequent years it now looks worse from 2024-25.

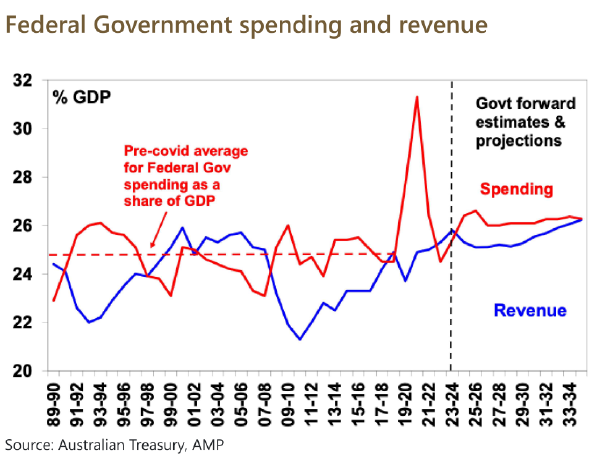

Due to new spending & structural pressures from interest costs, the NDIS, defence, health and aged care spending as a share of GDP is expected to average 26.2% over the longer term, well above the pre-Covid average of 24.8%. Despite a blip down with tax cuts, revenue trends up reaching its 1986-87 record of 26.2% of GDP in 10 yrs. So bracket creep, not spending restraint is assumed to do the work in getting us back to a budget balance.

After a surplus this year, there are bigger deficits over the next few years.

Gross public debt is projected to remain elevated at around 35% GDP before falling next decade.

Winners include: low and middle income households; pensioners; women; medicine users; aged & child care workers; low income renters; students; apprentices; home builders; students; defence; critical mineral projects; and clean energy manufacturers. Losers include: consultants, universities, foreign students, backpackers and dodgy NDIS providers.

The positives in the Budget include: another surplus; the cost-of-living measures will help ease pressure on the most vulnerable and some will lower measured inflation with a second round flow on to lower indexed price rises and inflation expectations; tax breaks & streamlined approvals should help boost medium term business investment; & there is still scope for revenue to surprise with commodity price assumptions.

However, the Budget has several significant weaknesses in relation to:

The direct lowering in measured inflation from cost of living measures will be welcomed by the RBA, but it will be wary of the rise in new stimulus. The net effect adds to the risk of higher for longer interest rates, but is probably not enough to change our forecast for a rate cut later this year.

Cash and term deposits — cash and bank deposit returns have improved substantially with RBA rate hikes and the Budget won’t change this much.

Bonds — another surplus takes pressure off bond yields, but this is offset by higher medium term deficits…so there is not much in it.

Shares – the Budget is positive for spending and hence retail shares, but this may be offset by higher than otherwise rates. Some manufacturers may benefit from FMIA. Overall, it looks neutral for shares.

Property — the housing measures are unlikely to alter the home price outlook which is dominated by supply shortages & high rates. We see modest home price growth this year.

The $A – the Budget is unlikely to change the direction for the $A.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Diana Mousina – Deputy Chief Economist, AMP

My Bui – Economist, AMP

Important note: While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

Planet Wealth

Planet Wealth Pty Ltd (ACN 137 467 362) as Trustee of the Planet Insurance and Financial Planning Unit Trust ABN 15 757 194 605 is an Authorised Representative and Credit Representative of AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licence 232706 and Australian Credit Licence 232706.

This information is provided by AMP Financial Planning Pty Limited (AMPFP) ABN 89 051 208 327 AFSL 232 706 and Charter Financial Services Limited (Charter) ABN 35 002 976 294 AFSL 234 655 Ph. 1800 021 466, both wholly owned subsidiaries of AMP and members of the AMP Group. Any advice contained in this document is of a general nature only and does not take into account the objectives, financial situation or needs of any particular person. Before making any decision, you should consider the appropriateness of the advice with regard to those matters. If you decide to purchase or vary a financial product, your advisers, AMPFP, Charter its associates and other companies within the AMP Group may receive fees and other benefits, which will be a dollar amount and/or a percentage of either the premium you pay or the value of your investments. Ask us for more details. Any general tax information provided is intended as a guide only and not to be relied upon. If you no longer wish to receive direct marketing, please call your adviser. To view our privacy policy visit AMP group privacy policy. AMP Advice is a trademark registered to AMP Limited ABN 49 079 354 519.

This website contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.

This website contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.