Welcome to the latest edition of our client newsletter,

Our articles cover a range of topics which we hope you will find interesting. We aim to keep you informed of changes as they happen, but we also want to provide ideas to help you live the life you want – now and in the future.

In this edition we discuss ” Negative gearing” and provide you with information on “Investments” and “Australian Wages”.

If you would like to discuss any of the issues raised in this newsletter, please don’t hesitate to contact us.

In the meantime we hope you enjoy the read.

All the best,

Planet Wealth

Planet Wealth

Planet Wealth

Planet Wealth Pty Ltd (ACN 137 467 362) as Trustee of the Planet Insurance and Financial Planning Unit Trust ABN 15 757 194 605 is an Authorised Representative and Credit Representative of AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licence 232706 and Australian Credit Licence 232706.

This information is provided by AMP Financial Planning Pty Limited (AMPFP) ABN 89 051 208 327 AFSL 232 706 and Charter Financial Services Limited (Charter) ABN 35 002 976 294 AFSL 234 655 Ph. 1800 021 466, both wholly owned subsidiaries of AMP and members of the AMP Group. Any advice contained in this document is of a general nature only and does not take into account the objectives, financial situation or needs of any particular person. Before making any decision, you should consider the appropriateness of the advice with regard to those matters. If you decide to purchase or vary a financial product, your advisers, AMPFP, Charter its associates and other companies within the AMP Group may receive fees and other benefits, which will be a dollar amount and/or a percentage of either the premium you pay or the value of your investments. Ask us for more details. Any general tax information provided is intended as a guide only and not to be relied upon. If you no longer wish to receive direct marketing, please call your adviser. To view our privacy policy visit AMP group privacy policy. AMP Advice is a trademark registered to AMP Limited ABN 49 079 354 519.

Negative gearing: Time to re-evaluate your strategy?

In the space of 18 months, interest rates have risen regularly, which has seen plenty of positively or neutrally geared investment properties slip into negative territory. After a significant jump in the cash rate, savvy investors are now rethinking their medium to long-term strategies.

While some property investors actively choose a negative gearing path, others have only recently found themselves navigating the oft-talked about mortgage method due to the fast-paced interest rate climate. There are tax-related perks that come with negative gearing, but the strategy doesn’t necessarily make sense for everyone. To work out if negative gearing is right for you, it might be time to give your property investment plan a ‘health check’.

Advantages of negative gearing

Put simply, negatively gearing your property investment means spending more on your mortgage interest payments and expenses than you’re getting in rental payments. In this case you’re effectively not earning an income from the property, but it does mean you can write off these losses at tax time. Although the investment property is costing you (rather than providing income), the negative gearing pay day hopefully comes in the form of capital growth.

Disadvantages of negative gearing

While some investors swear by the strategy, negative gearing does come with downsides. You’ll be making an ongoing loss and won’t generate a passive income to help pay for the property’s holding costs. Another drawback is the potential for a capital loss. Investors get into real estate to make money, but there are no guarantees.

What is positive gearing?

On the flip side of negative gearing, positive gearing takes the opposite approach, whereby the income you earn from your investment property is higher than your expenses. This tactic is ideal for investors looking for consistent returns and a passive income. And if the property increases in value there will be capital gains on top of your rental income when you come to sell. You will pay tax on your rental income and with rising rates, it can be more challenging to find suitable properties which fit the strategy.

Neutral gearing explained

If your investment property costs you nothing, but also earns you nothing, then it is neutrally geared. It’s a rare approach because it’s difficult to perfectly align both the expenses and earnings but can work well for anyone investing through a self-managed super as it won’t eat into the fund’s wealth.

What to consider when negative gearing

It’s important to cover all your bases when working out whether negative gearing is the right strategy for your personal circumstances and the property in question. Prepare yourself by asking;

Is negative gearing still worth it?

As the cost of living – and the price of holding a mortgage – continues to increase, negative gearing will eat more and more into your monthly expenses. While it can be a highly effective strategy to reduce your tax bill and unlock capital gains, there are a lot of other things to consider. If your household budget is already tight in the current climate, then perhaps this isn’t a path for you. However, if you have crunched the numbers and are confident you can absorb the extra costs then negative gearing might just be the right fit.

While we can assist with your overall financial strategy, a mortgage broker can help find a loan that best suits your circumstances.

Interest rates are an important financial lever for world economies. They affect the cost of borrowing and the return on savings, and it makes them an integral part of the return on many investments. It can also affect the value of the currency, which has a further trickle-down effect on other investments.

So, when rates are low they can influence more business investment because it is cheaper to borrow. When rates are high or rising, economic activity slows. As a result, interest rate movements are also a useful tool to control inflation.

For the past few years, interest rates have been close to zero or even in negative territory in some countries, but that all started to change over the last year or so.

Australia lagged other world economies when it came to increasing rates but since the rises began here last year, the Reserve Bank of Australia (RBA) has introduced hikes on a fairly regular basis. Indeed, the base rate has risen 4 per cent since May last year.

The key reason for the rises is the need to dampen inflation. The RBA has long aimed to keep inflation between the 2 and 3 per cent mark. Clearly, that benchmark has been sharply breached and now the consumer price index is sitting at 6 per cent for the quarter to June 2023.

There are two sides to rising interest rates. It hurts if you are a borrower, and it is generally welcomed if you are a saver.

But not all consequences of an interest rate rise are equal for investors and sometimes the extent of its impact may be more of a reflection of your approach to investment risk. If you are a conservative investor with cash making up a significant proportion of your portfolio, then rate rises may be welcome. On the other hand, if your portfolio is focussed on growth with most investments in say, shares and property, higher rates may start to erode the total value of your holdings.

Clearly this underlines the argument for diversity across your investments and an understanding of your goals in the short, medium, and long-term.

Higher interest rates tend to have a negative impact on share markets. While it may take time for the effect of higher rates to filter through to the economy, the share market often reacts instantly as investors downgrade their outlook for future company growth.

In addition, shares are viewed as a higher risk investment than more conservative fixed interest options. So, if low risk fixed interest investments are delivering better returns, investors may switch to bonds.

But that does not mean stock prices fall across the board. Traditionally, value stocks such as banks, insurance companies and resources have performed better than growth stocks in this environment.i Also investors prefer stocks earning money today rather than those with a promise of future earnings.

But there are a lot of jitters in the share market particularly in the wake of the failure of a number of mid-tier US banks. As a result, the traditional better performers are also struggling.

Fixed interest investments include government and semi-government bonds and corporate bonds. If you are invested in long-term bonds, then the outlook is not so rosy because the recent interest rates increases mean your current investments have lost value.

At the moment, fixed interest is experiencing an inverted yield curve, which means long term rates are lower than short term. Such a situation reflects investor uncertainty about potential economic growth and can be a key predictor of recession and deflation. Of course, this is not the only measure to determine the possibility of a recession and many commentators in Australia believe we may avoid this scenario.ii

House prices have fallen from their peak in 2022, which is not surprising given the slackening demand as a result of higher mortgage rates.

Australian Bureau of Statistics data showed an annual 35 per cent drop in new investment loans earlier this year.iii

The changing times in Australia’s economic fortunes can lead to concern about whether you have the right investment mix. If you are unsure about your portfolio, then give us a call to discuss.

Current as at Sep 2023

AMP’s Deputy Chief Economist, Diana Mousina explains the slow growth of Australian wages and the impact on inflation.

Wages increased by 0.8% in the June 2023 quarter, equating to 3.6% year on year which was slightly below expert predictions.

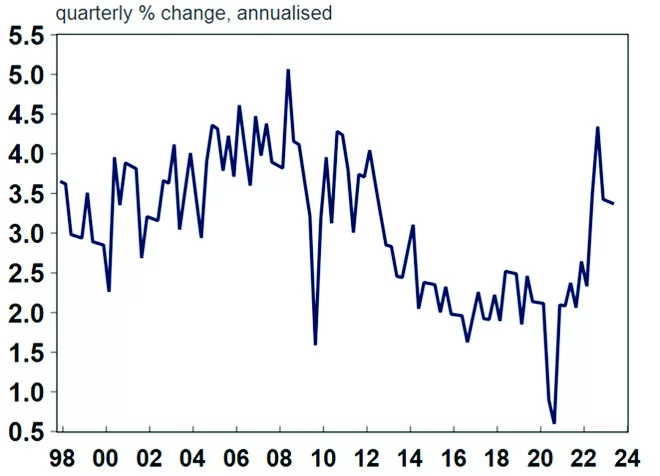

If you include bonuses, the pace of growth slowed to 3.7% year on year, from 3.9% last quarter. On an annual basis, this means wages growth is running at 3.4%, well below the peak of 4.3% in September last year but still around a 10-year high. Before the pandemic, it was around 2% a year. The tight labour market and high inflation have helped to increase wages in recent years.

The main drivers in the June quarter were construction (+1.3%) and professional, scientific and technical services (+0.7%).

Source: Macrobond, AMP

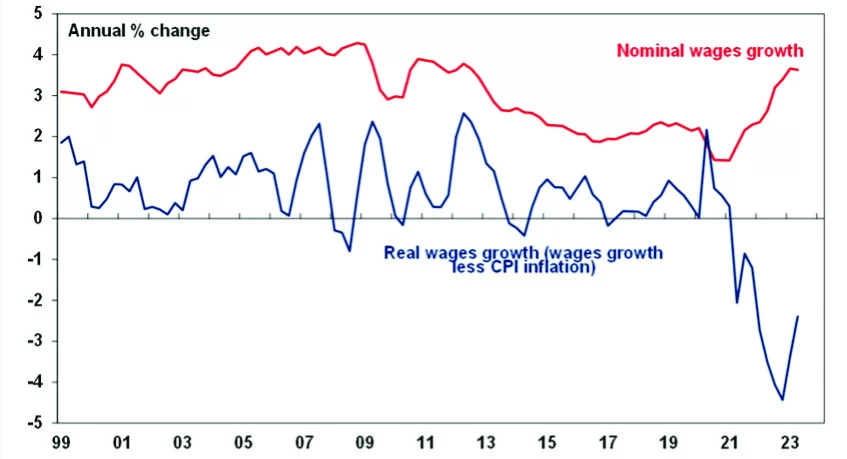

Once you add inflation into the mix, it’s a very different picture with real wages going backwards. But as inflation slows, the rate of decline is slowing and is now at -2.4% year on year, up from a low of -4.4% in December last year. And we should see further improvement in real wages from here as inflation slows, which is positive for consumer sentiment and household purchasing power.

Source: ABS, AMP

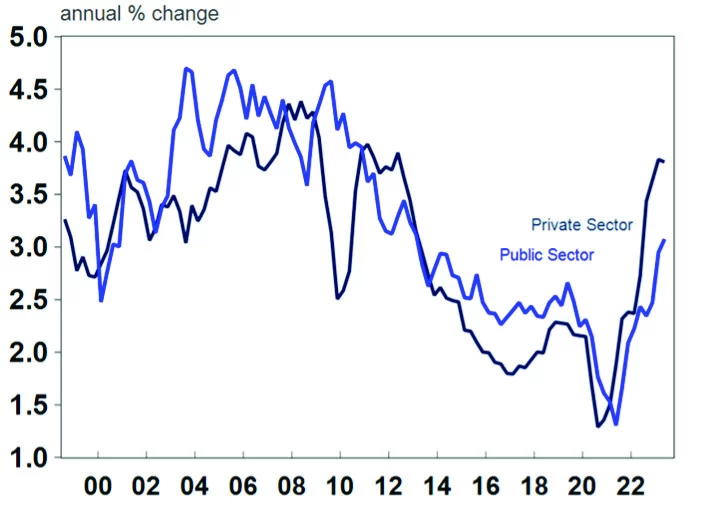

Wages growth in the private sector was up by 3.8% over the year to June, compared to 3.1% in the public sector. But we’re likely to see a turnaround as increased unemployment affects the private sector more.

Source: ABS, AMP

Wages should grow more strongly in the September quarter due to the impact from the increased minimum and award wages brought in on 1 July 2023.

We see growth peaking at just under 4% later in the year before a slowdown in the labour market takes some heat out. But wages growth could still be higher than expected, depending on the speed of the slowdown and any broader wage gains stemming from the minimum and award wage changes.

While wages aren’t increasing at a pace that would threaten the Reserve Bank’s 2-3% inflation target, they’re still a risk to inflation, particularly as productivity growth remains low.

So, while the June figures allow the Reserve Bank to breathe a sigh of relief and keep rates on hold, any signs that wages growth is reaccelerating would be a cause for concern.

This article has been written by Diana Mousina, Deputy Chief Economist at AMP.

Important note: While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

Current as at Sep 2023

This website contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.

This website contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.