Welcome to the latest edition of our client newsletter,

Our articles cover a range of topics which we hope you will find interesting. We aim to keep you informed of changes as they happen, but we also want to provide ideas to help you live the life you want – now and in the future.

In this edition we discuss “Reasons for increasing Inflation” and provide you with information on “Managing the cost of raising kids” and “Time to Spring clean your finances”.

If you would like to discuss any of the issues raised in this newsletter, please don’t hesitate to contact us.

In the meantime, we hope you enjoy the read.

All the best,

Planet Wealth

Planet Wealth

Planet Wealth

921, High St Road, Glen Waverley, Vic 3150

Planet Wealth Pty Ltd (ACN 137 467 362) as Trustee of the Planet Insurance and Financial Planning Unit Trust ABN 15 757 194 605 is an Authorised Representative and Credit Representative of AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licence 232706 and Australian Credit Licence 232706.

This information is provided by AMP Financial Planning Pty Limited (AMPFP) ABN 89 051 208 327 AFSL 232 706 and Charter Financial Services Limited (Charter) ABN 35 002 976 294 AFSL 234 655 Ph. 1800 021 466, both wholly owned subsidiaries of AMP and members of the AMP Group. Any advice contained in this document is of a general nature only and does not take into account the objectives, financial situation or needs of any particular person. Before making any decision, you should consider the appropriateness of the advice with regard to those matters. If you decide to purchase or vary a financial product, your advisers, AMPFP, Charter its associates and other companies within the AMP Group may receive fees and other benefits, which will be a dollar amount and/or a percentage of either the premium you pay or the value of your investments. Ask us for more details. Any general tax information provided is intended as a guide only and not to be relied upon. If you no longer wish to receive direct marketing, please call your adviser. To view our privacy policy visit AMP group privacy policy. AMP Advice is a trademark registered to AMP Limited ABN 49 079 354 519.

Four reasons inflation may rise again… and why we think it won’t

AMP Deputy Chief Economist Diana Mousina looks at the inflation outlook.

Inflation across most major economies has been slowing noticeably over recent months. While it may seem like the fight against inflation has been won by central banks, some recent indicators have ticked up again which could see inflation take financial markets by surprise and start rising again in late 2023/early 2024.

Here are four indicators that could put pressure on inflation.

NAB Survey: Price Indicators

Purchasing Managers’ Indices (PMIs) are a good leading indicator of global activity. After declining since mid-2022, input and output costs have stabilised in recent months and some look to be picking up again.

As you can see in the chart below, Australian price indicators have also been trending up, especially in July, although this could be a one-off spike because of the decision to lift the minimum wage in June.

The trends in these price surveys are worth watching, as they tend to lead the hard inflation data.

Source: Bloomberg, AMP

Global Food Prices and Consumer Inflation

Extreme weather events can disrupt food production and supply leading to volatility in food prices. While central banks usually look through spikes in prices, the events of the past few years have shown that temporary price changes can seep into numerous components of the supply chain. After large increases in food prices throughout 2021-22, food inflation is expected to slow further – see the chart below.

There’s a risk that El Niño weather patterns will lead to higher Australian agricultural prices over the next 3-6 months. Outside Australia, El Niño also tends to be inflationary as non-fuel commodity prices rise, fuel prices increase (coal and crude oil demand rises as there’s lower output from hydroelectric power plants) and governments may decide to restrict supply of agricultural commodities.

Beside these weather disruptions, many commodity prices have been increasing lately including gas, coal and oil, which will add to higher near-term inflation.

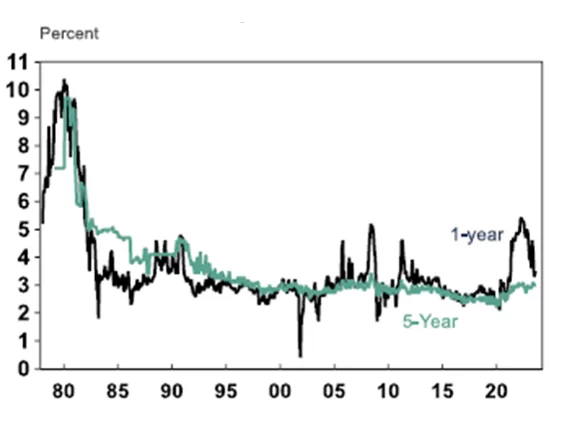

US University of Michigan Consumer Inflation Expectations

US short-term inflation expectations have come down from their 2022 highs and medium-term expectations are still well contained but have drifted higher over the past months and are around 3% – the top end of central bank’s target range. Inflation expectations need to remain anchored to keep actual inflation contained.

Source: Macrobond, AMP

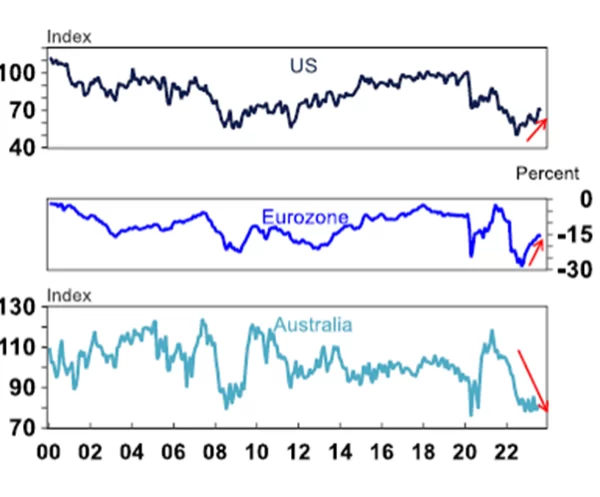

Global Consumer Confidence

The slowing in headline inflation has led to a rise in real wages growth (the difference between nominal wages and inflation) around the world, although it’s still negative in Australia and the Eurozone. A rise in real wages could see consumers increase spending and lead to a rise in inflation again.

The increase in real wages growth appears to have led to a rise in consumer confidence (see the chart below) in the US and Eurozone. Australian consumer confidence is still around record lows.

What this means for investors

The rate of inflation could start increasing again leading to renewed concern about further rate hikes, higher bond yields and the risk of a recession which would be negative for share markets.

While this is a risk, we still see inflation headed lower through 2023 and into 2024 due to restrictive interest rates. But it’s worth watching the leading inflation indicators for signs of movement.

In the longer term, inflation is likely to remain higher than pre-COVID levels due to:

There may be some offset from productivity improvements related to technology (and more specifically artificial intelligence) which could help to keep inflation down.

This article has been written by Diana Mousina, Deputy Chief Economist at AMP.

Current as at October 2023

Important note: While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

Managing the rising costs of raising kids

It is a special feeling to welcome a new child or grandchild into the world and watch them grow. Sharing their joy as they reach new milestones is priceless.

Of course, there is a real cost – raising a child is expensive, particularly now as the cost-of-living spirals higher. Estimates vary widely from the few studies completed but it is fair to say that over a child’s lifetime families can spend hundreds of thousands of dollars on living, medical and schooling expenses for their children.

So, having a financial strategy in place to cover the costs and taking advantage of government support where available can make a big difference.

The first step is to update your Will to nominate guardians for your children in case the worst happens. You may also consider life insurance and income protection to ensure your family is protected.

Next, a savings and investment plan will help you navigate the years ahead with more certainty. Adding small amounts of money regularly to an account for education and other expenses can help to ease financial stress. The MoneySmart savings goals calculator shows what can be achieved. You could consider fee-free high interest savings accounts or your mortgage offset account as a way to save cash for short-term needs.

Meanwhile, some longer-term investments such as shares, exchange traded funds or listed investment companies may provide financial support for later expenses. They can offer the possibility of capital growth and diversification for a relatively low cost.

Keeping an eye on the future also means thinking about your superannuation. If one partner is staying at home to care for the children, the other partner can split their super contributions with them. You will need to check if your fund allows it, whether they charge a fee and complete some paperwork.

There are also some tax considerations, so it is important to make sure you understand the implications for you.

Take the time to discover the government payments and supports available for families. For example, the Paid Parental Leave Scheme provides support for mothers for up to three months before the birth.

A recent change to Parental Leave Pay and Dad and Partner Pay sees these two payments combine into one payment that is available to both parents for up to two years after the child’s birth.

You will need to meet income and work tests and claim within certain timelines.

Even if you are not eligible for parental leave pay, you may still be able to apply for both the Newborn Upfront Payment and the Newborn Supplement.

Then there is the Family Tax Benefit, a two-part payment to help with the cost of raising children. To receive the benefit, you must have a dependent child or a full-time secondary student aged 16 to 19 who is not receiving any other payment or benefit such as a youth allowance, care for the child at least 35 per cent of the time and meet an income test.

Grandparents who are keen to help out their families financially can gift money to their children or grandchildren. Be aware that Centrelink has gifting rules for those receiving an age pension. You can give $10,000 in one year or up to $30,000 over five years without your pension being affected. If you give more, the amount will be treated as though you had retained it in your own accounts.

However, gifts and inheritances are generally not considered as income for tax purposes. The ATO says neither the donor nor the receiver will pay tax on a gift if:

Tax may apply in some cases where property or shares are gifted.

The joys of raising a little one are many, and having a plan to manage the financial implications can let you enjoy the journey. Get in touch with us to create a plan to secure your family’s future.

Current as at October 2023

Time to Spring clean your finances?

Spring is a time of renewal and regrowth, a time to dust off the cobwebs and let the sunshine in, and it’s also a good time of year to take a look at your finances.

It’s been a challenging year on many fronts and spending a day getting on top of the state of your finances, putting some measures in place to make some savings, could be time well spent.

Try to arrange your financial spring clean on a weekday so you have scope to call banks, credit card issuers, health insurers, and other financial services providers who are easier to contact during office hours. And you will also need all your tools — financial records, current tax return, mortgage, credit card and bank statements — close at hand. Internet access is also important as there are many things you can do online.

So, what are your objectives? Well, there are two sides to this coin. The first objective is to put more $$ in your pocket by saving a little more of and spending a little less of your income, without making your life a penny-pinching misery in the process. The second is to discover some cheaper ways, if they exist, to pay for some of life’s essentials.

Start at the beginning by reviewing your monthly budget — or constructing one, if necessary — so you can pinpoint the big expenses before trying to pare them back. Take your power bills, for example. Some power companies will not only reward you with a discount for combining your gas and electricity, but they will also allow you to pay them with a pre-set monthly direct debit, avoiding the shock of that big quarterly hit and smoothing your cash flow.

Monthly payments or saving targets can be an excellent budgeting tactic. In fact, you can even create your own monthly debit system for major expenses such as school fees, annual holidays and Christmas by estimating the cost and transferring monthly instalments to a separate savings account. You’ll most likely be able to setup automatic transfers with your bank so your savings build over time, without a second thought.

If you can manage it painlessly by cutting one or two unnecessary expenses, one good outcome of a budget review would be to save an extra 5-10% per cent of your salary — just $5-$10 out of every $100 you earn — for a major objective like a renovation or even pumping up your rainy-day fund. The best budgets can be ruined by unexpected emergencies, whether it is a burst water heater or a change in your financial circumstances.

Once you have your budget review completed and have set up new direct debits and/or opened one or two new dedicated savings accounts, you should still have a few hours of your Financial Spring-cleaning day left to look for some significant savings on financial services.

Credit cards are a black hole in many budgets. Could you save by switching to a cheaper card? Are you paying off your card within the interest-free period? What about rewards programs — if you are paying for them, are you using them? Some supermarket reward programs now offer a “double reward” so it may pay to investigate your options. You can compare cards online at several sites such as www.creditcards.com. And, if you do decide to change card companies, you might find one that will give you an interest rate holiday for the first 3–6 months as a reward for switching.

A recent Choice survey found 82% of Australians are concerned about health costs, making it the main household cost concern.2 Your current health insurance plan may be worth reviewing because your family circumstances might have changed since you took out the plan, or the market may have newer, more flexible options providing better value. There are many sites that allow you compare plans, including a government comparison website www.privatehealth.gov.au.

And finally, have a think about your goals and dreams and make sure that any decisions you are making in the present are not at the expense of your future financial security.

All done? Congratulations on a day well spent!

Current as at October 2023

This website contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.

This website contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information.

Planet Wealth Pty Ltd ACN 137 467 362 as Trustee of the Planet Insurance and Financial Planning Unit Trust ABN 15 757 194 605, is an Authorised Representative and Credit Representative of AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licence 232706 and Australian Credit Licence 232706