Different sectors of the economy are impacted at different times by shocks like tighter monetary policy. So various sectors of the economy may have “recessions” but at different times such that the overall And in Australia a record level of household debt servicing costs to – income add to the local risk of recession which we put at 50%. But after “predicting” 4 of the last two recessions in Australia – one of which was the pandemic recession which flowed from lockdowns so shouldn’t really count – and seeing lots of incorrect forecasts of global doom over the years, I am all too aware of recession calls turning out to be wrong. Which partly explains my reluctance to go beyond 50/50 at present for Australia.

The first point to note is things like yield curves and leading indicators can get it wrong in forecasting recession. Yield curves have several issues:

- The lag from yield curve inversion in the US can be 18 months. Various versions of it first inverted between July last year and January this year. So given normal lags it may not eventuate until next year.

- More positively though US yield curve inversions have given false signals in the past, eg, in 1998.

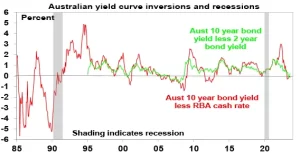

- Inverted yields curves have been a poor indicator of recession since 1991 in Australia and right now it’s not decisively inverted anyway.

There are in fact several ways a recession might still be averted.

The Case For A Recession

The Case For A Recession Third, Households Still Have Pandemic Savings Buffers

Third, Households Still Have Pandemic Savings Buffers