Overview and outlook

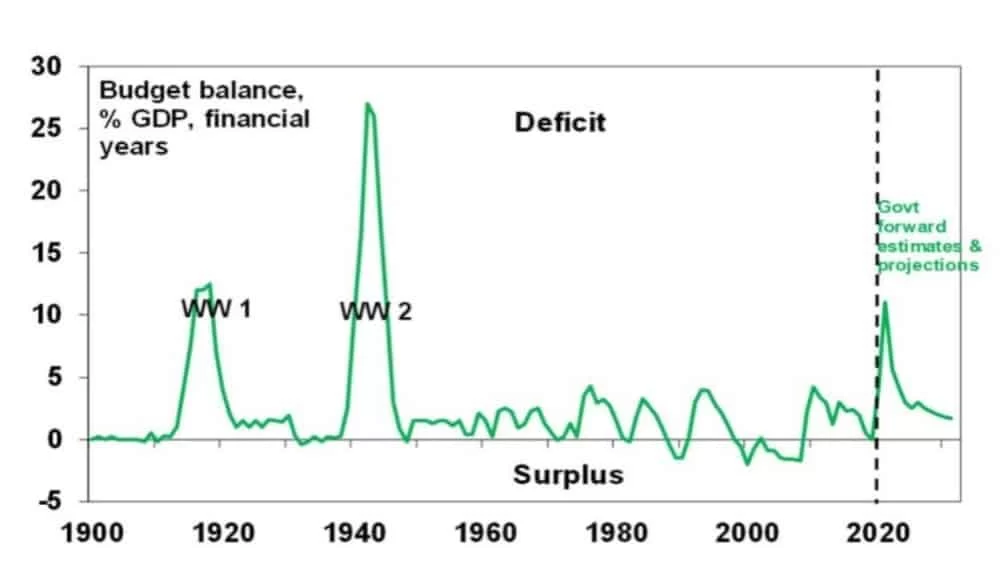

The Australian budget was released in October and focused on economic recovery by providing more stimulus to boost spending and reduce unemployment. The government expects the budget deficit to peak at $213.7b this financial year (FY21), the highest since the end of WW2.

Australian Federal budget deficit

Source: RBA, Australian Treasury, AMP Capital

To increase consumer and household spending within the current low interest rate environment, the government is planning to bring forward the 2022 tax cuts to July 2020. The government will also promote business investments by reinstating R&D tax breaks and instant expensing for tax purposes for companies with turnover up to $5b.

To boost employment the government’s budget has announced a $3b ‘use it or lose it’ infrastructure package to state governments and a new $1.2b ‘JobMaker’ wage subsidy for apprentices. In addition, the extension of the First Home Loan Deposit Scheme and the ‘HomeBuilder’ grant seeks to increase jobs within the construction sector.

The RBA met expectations and cut cash and Term Funding Facility (TFF) rates to 0.1%. The TFF was established in March to offer authorised deposit-taking institutions (ADI’s) a low-cost source of funding to supply credit to the economy. These rate cuts will lower financing costs for borrowers even more and contribute to a lower exchange rate which will help boost exports.

The table below provides details of the movement in average investment returns from various asset classes for the period up to 31 October 2020.

Past performance is not a reliable indicator of future performance. The Global Listed property reference index changed to FTSE EPRA/NAREIT Developed Rental NR Index (AUD Hedged) as of August 2019

Getting Expert Help

We can work with you to create a plan to help give you the peace of mind from the day you announce your happy news, to the day your little ones leave the nest.

As part of the RBA’s quantitative easing (QE) program, they have committed to keep 3-year government bond yields at 0.1% by purchasing them in the secondary market. Over the next 6 months, an additional $100B will also be used to purchase 5- and 10-year government bonds to keep longer-term yield curves in line with the current cash rate.

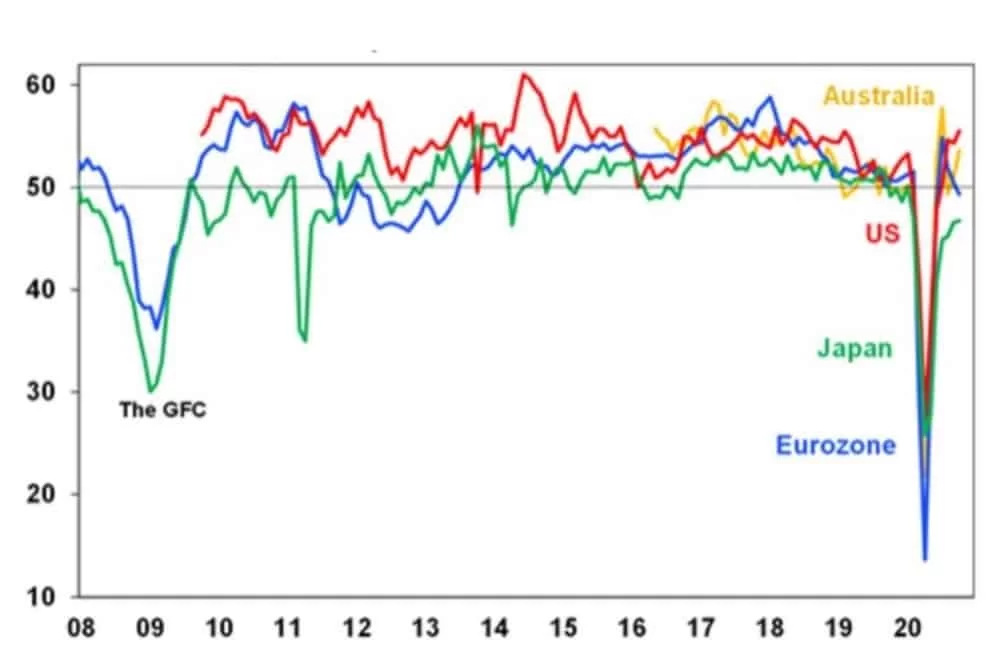

The US quarter on quarter Q3 GDP growth (8.0%), with an annualised rate of 33.1%, was a better than expected result and combined with the rise in composite PMI (which tracks business expectations in the service and manufacturing industries) to 55.5 indicates economic expansion. The expected improved October unemployment figure (7.7%) along with a surge in home sales and new home construction also highlights the US’ road to a strong recovery.

As the US elections are underway, whether Trump or Biden wins will affect global markets in several ways. If Trump wins, trade tensions with China are expected to escalate which would drive global markets down and strengthen the USD as tax and regulation changes remain low. If Biden wins, the market expects volatility to decrease as it is more likely that trade wars will lessen.

As the second wave of the pandemic hit Europe, consumer confidence (-15.5) fell as households reported growing concerns about their financial situation. Despite a strong Q3 GDP quarter on quarter increase of 12.7%, renewed fears of the virus and worsening unemployment figures (8.3%) stalled economic recovery in October.

G3 & Aust composite business conditions PMIs

Source: Markit, AMP Capital

Share markets

Australian equities (1.9%) and Smaller companies (0.5%) showed modest returns driven by positive outlook from the federal budget and rallies in the US market due to stimulus deal hopes early in the month. This was partially offset in the last week by lockdowns in Europe and rising global Covid-19 cases. Banks led Financials (6.3%) after the budget revealed stronger stimulus support for households while a global tech rally helped the local Info Tech (9.0%) sector rise amid signs that the correction in tech stocks has bottomed.

International Shares (-3.2%) on a currency hedged basis fell. New mobility restrictions in Europe from increasing Covid-19 cases and the failed agreement on a US stimulus deal before the elections weighed heavily on investor sentiment. The tightening of US elections polls also increased uncertainty in the global markets.

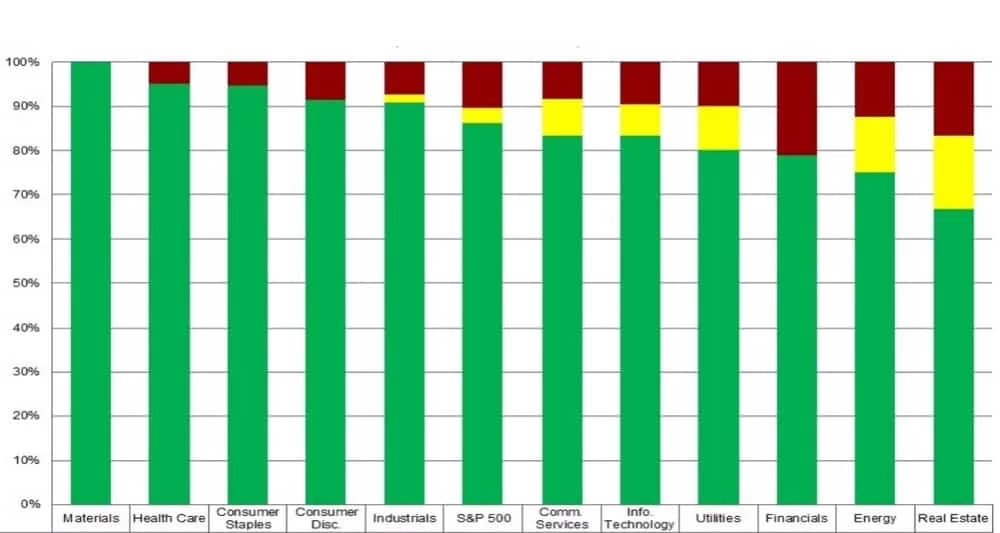

As US reporting continues, 64% of the US S&P 500 companies have now reported Q3 earnings. Of those, 86% (76% in 2019) reported a positive EPS surprise and 81% (61% in 2019) reported a positive revenue surprise. Materials, Health Care and Consumer Staples had the highest percentages of companies reporting earnings surprises and Consumer Discretionary reported the largest earnings surprise difference. With more than half the US S&P 500 companies reporting unexpected earnings, the US market is recovering strongly and suggests that the worst of the pandemic is over. The chart below shows the percentage of companies by sector with earnings above estimates (green), earnings in-line with estimates (yellow) and earnings below estimates (red).

S&P Earnings Above, In-Line, Below Estimates: Q3 2020

Source: FactSet

Emerging markets (4.2%) on an unhedged basis outperformed both the local and international markets led by China (3.9%) as it relaxed its province border restrictions and reported a year-on-year Q3 GDP growth of 4.9%.

Interest Rates

Australian fixed interest (0.3%) remained steady throughout the month. The November RBA announcement of a rate cut to 0.10% along with QE policies was largely what was expected in October and Australian 10-year bond yields fell by 7 bps.

International fixed interest (0.0%) remain unchanged. As lockdown across Europe begins again, Germany (-9.7 bps) and France (-9.1 bps) 10-year bond yields offset the rise in US 10-year bonds (+19.5 bps) which was due to expectations of a stimulus package, strong Q3 results and the Fed’s small business lending program. The disconnect between bonds and US equities (-2.3%) shows that using bonds as a defensive allocation may be becoming less effective.

The Australian dollar (-1.9%) fell due to uncertainty in US elections and RBA’s updated monetary and QE policies.

Property

Australian property (-0.3%) outperformed the global property market (-3.3%). Major detractors to local REIT’s include Scentre Group (-5.0%) and Dexus Group (-5.6%) as the pandemic is still affecting their retail portfolios. In particular, Mirvac Group (-5.8%) indicated Q3 retail rent collection of only 64%. Travel restrictions in Europe and the rise in Covid-19 cases is providing negative outlook for international REIT’s.

Planet Wealth Pty Ltd (ACN 137 467 362) as Trustee of the Planet Insurance and Financial Planning Unit Trust ABN 15 757 194 605 is an Authorised Representative and Credit Representative of AMP Financial Planning Pty Limited ABN 89 051 208 327 Australian Financial Services Licence 232706 and Australian Credit Licence 232706.

Any advice contained in this document is of a general nature only and does not take into account the objectives, financial situation or needs of any particular person. Before making any decision, you should consider the appropriateness of the advice with regard to those matters. If you decide to purchase or vary a financial product, your advisers, our practice, AMP Financial Planning, its associates and other companies within the AMP Group may receive fees and other benefits, which will be a dollar amount and/or a percentage of either the premium you pay or the value of your investments. Ask us for more details. If you no longer wish to receive direct marketing from us please call us on the number in this document and if you prefer not to receive services information from AMP, you may opt out by contacting AMP on 1300 157 173. To view our privacy policy visit www.amp.com.au